Private equity investment transactions are increasingly complex, and competition for the best deals is intense. Experienced, commercially aware and pragmatic advisers can be the key difference in closing transactions.

These challenges mean that the power to tap into experience, efficiency and the ability to innovate are now more important than ever for private equity sponsors.

What do our private equity experts do?

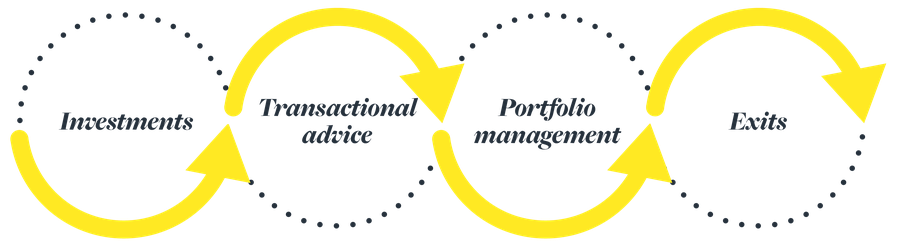

Private equity transactions sit at the very heart of our corporate work. Our private equity team have extensive experience advising private equity firms, management teams and portfolio companies on a broad range of transactions including investments, buy-and-build and other bolt-on acquisitions and exits, whether effected via trade sale, secondary buyout, or IPO. From working for and opposite many private equity funds, we understand pinch points in negotiations and can navigate these to avoid delays and unnecessary costs.

At our core, we’re dealmakers and we never lose sight of getting the deal over the line and with the best outcome for all involved. We offer straight-talking, pragmatic advice and have a proven track record of becoming trusted advisers to private equity firms and businesses across their investment and growth journey. And because private equity opportunities aren’t restricted to London alone, we operate where our investors do, helping to open up attractive investment opportunities wherever they are.